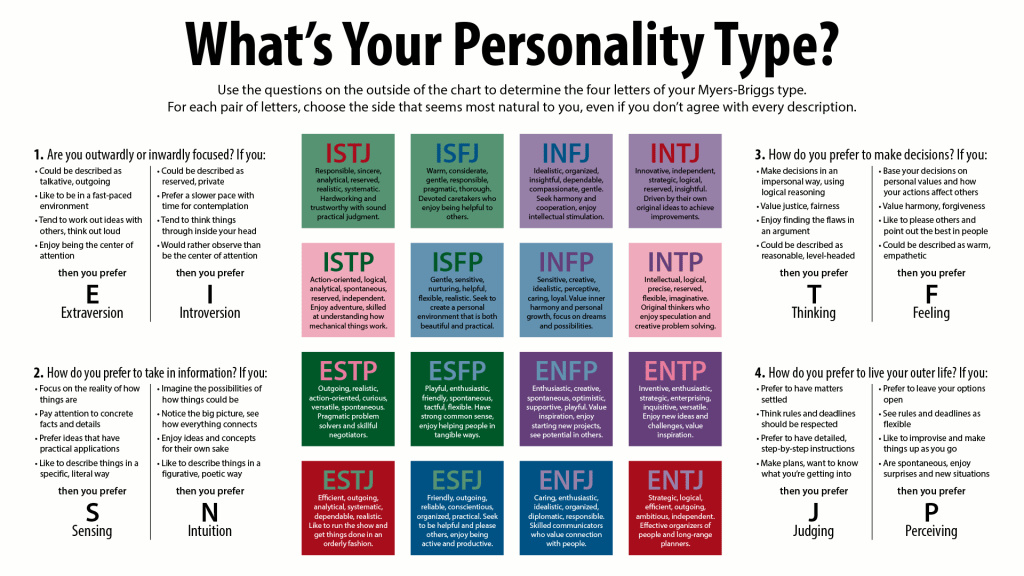

Developed by Katherine Briggs and Isabel Myers, the Myers-Briggs Type Indicator (MBTI) is a self report questionnaire which characterizes an individual’s personality type through how they perceive the world and make decisions (The Myers-Briggs Foundation, 2014). The MBTI is based on the theories of Carl Jung. Jung speculated that people experience the world using four functions: sensation, intuition, feeling, and thinking. Jung’s theory states that one of the four functions is dominant within an individual most of the time (The Myers-Briggs Foundation, 2014). The MBTI uses four categories to define one’s personality: introversion or extroversion, sensing or intuition, thinking or feeling, and judging or perceiving. These categories create sixteen unique personality types (The Myers-Briggs Foundation, 2014). These sixteen personality types and their traits are described in the image below:

Each of these personality types “…have specific preferences in the way [they] construe [their] experiences, and these preferences underlie [their] interests, needs, values, and motivation” (Kaplan & Saccuzzo, 2009, p. 502) Therefore, one would expect that each of these MBTI types have a different relationship with their finances. Keyishian, 2020 estimated a pattern in how each of these different personality types would handle their personal finances. Each of these MBTI types’ patterned behavior was placed within a relevant category. The categories were: protectors, planners, pleasers, and players (Keyishian, 2020). A description of each category and a list of its respective personality types can be found below:

PROTECTORS

- ESTJ

- ESFJ

- ISTJ

- ISFJ

By nature, protectors (who make up 38% of the population) are very conservative with their finances (Keyishian, 2020). “They think ahead, make sure their future is taken care of, buy the same brands, and shop at the same stores” (Keyishian, 2020, para. 8). Although this may sound like a sensible approach to handling one’s finances, protectors often experience a lot of stress related to their money. For example, any sort of risk related to a protector’s finances is extremely anxiety-inducing. Scheduling a vacation or investing in the stock market can be difficult for protectors, even if it benefits them in the long-run (Keyishian, 2020). Furthermore, protectors loath unanticipated change such as spending money on an unplanned repair. To avoid any undue stress, it is recommended that protectors keep an emergency fund. Having some money set aside for a rainy day will likely ease any anxieties about unplanned spending (Keyishian, 2020).

PLANNERS

- ENTJ

- ENTP

- INTJ

- INTP

Those who fall within this category are future-focused and tend to concentrate on long-term investing. Planners (who make up about 12% of the population) succeed at evaluating risks and creating contingency plans (Keyishian, 2020). They are also great at big-picture thinking and building plans according to their vision. However, sometimes those within this category are so focused on the future that they miss important opportunities in the present. In other words- analysis paralysis (Keyishian, 2020). Many planners make great money but are so focused on long-term savings that they never get to enjoy their earnings. It is recommended that planners select a portion of their income to divert immediately to long-term savings, and select another portion to divert to indulgences today (Keyishian, 2020).

PLEASERS

- ENFJ

- ENFP

- INFJ

- INFP

Pleasers (who make up about 12% of the population) tend to take their finances very personally. Those who fall within this category view money as an extension of themselves. Therefore, how they spend it is an expression of their identity (Keyishian, 2020). Through their money, these personality types either want to please themselves or others. Unfortunately, this means pleasers are often taken advantage of in terms of their finances (Keyishian, 2020). Those who recognize a pleaser’s desire to put others’ needs before their own will likely leave a pleaser broke. Even pleasers more focused on fulfilling their own needs can fall into this trap. For example they may overspend “because I’m worth it” (Keyishian, 2020, para. 19). It is advised that these personality types avoid those who may manipulate their financial decisions (Keyishian, 2020).

PLAYERS

- ESTP

- ESFP

- ISTP

- ISFP

Players (who make up about 38% of the population) are among the personality types with the highest financial risk (Keyishian, 2020). Characterized as compulsive and carefree, these personalities can end up in financial ruin if they are not cautious. Players love being able to freely react to the moment. Although this can be a dangerous trait, in the right circumstance, it can be incredibly entrepreneurial as well. With their resourcefulness, can-do attitude, and the help of an accountant, many players can become superb entrepreneurs (Keyishian, 2020).

References:

Kaplan, R. & Saccuzzo, D. (2009). Psychological testing: Principles, applications, and issues.

Keyishian, A. (2020). What your personality type means for your finances. Retrieved from https://www.themuse.com/advice/what-your-personality-type-means-for-your-finances

The Myers-Briggs Foundation. (2014). MBTI basics. Retrieved from https://www.myersbriggs.org/my-mbti-personality-type/mbti-basics/home.htm?bhcp=1

Image References:

Owens, M. (2015). Believe it or not, your personality type can predict how much you’ll earn, how much far you’ll rise, and whether you’ll love your job. Retrieved from https://www.truity.com/blog/personality-type-career-income-study-2015

Beech, J. (2014). What’s your personality type? Retrieved from https://creativecommons.org/licenses/by-sa/3.0/